- Alternative Investing Report

- Posts

- Alternative Investing Report - December 5, 2025

Alternative Investing Report - December 5, 2025

Happy Friday. A $5 billion IPO is coming, VC funding keeps rising, starter homes are finding buyers and Slava Rubin gives us an investing pick. Let’s dive in!

🎫 Learn: How an investor should break down a real estate deal in our next briefing - 12/9 at 11 AM ET.

This issue is brought to you by Lightstone DIRECT - targeting 15%+ IRR with immediate cashflow.

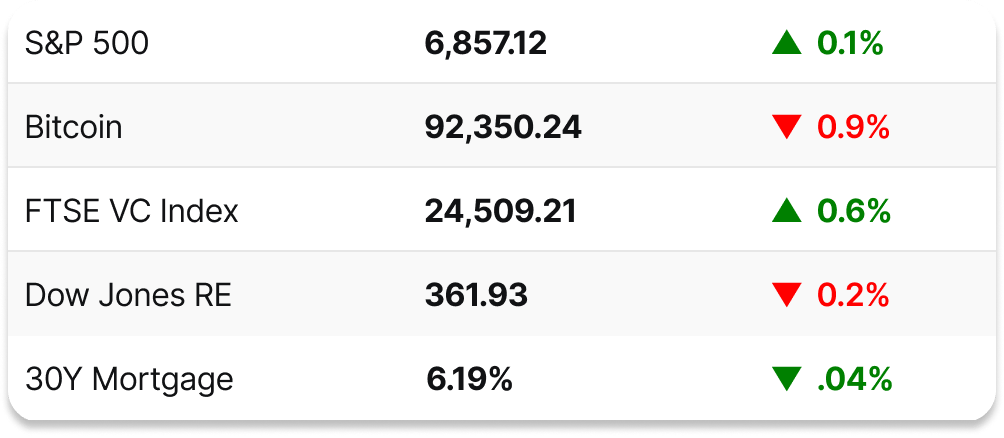

📈 DAILY MARKETS

✅ PICK OF THE WEEK

Anthropic

Most recent valuation: $183 billion (September 2025), but last month’s partnership deal implies the company is valued at $350 billion.

For investors looking to ride the wave of AI, Anthropic is more focused than OpenAI at a lower valuation

It is becoming the industry favorite for engineers to access via API

The company is seeing strong revenue growth via vibe coding

Rumors are that the company will pursue an IPO within the next three years

Here’s a list of our past expert investing picks.

How do you feel about today's pick? |

👨🏫 TODAY'S EXPERT

Slava Rubin was co-founder and CEO at indiegogo in addition to being co-founder at Vincent, co-founder at Nillion and Co-founder and Managing Partner of Humbition, an early stage venture fund. He is also currently a member of the board for NYSE traded (WSO) Watsco Inc.

Partner

Abernathy Industrial Park now open to investors

Abernathy Industrial Park in South Carolina, Lightstone DIRECT’s first offering, is currently open to investors. It is a fully leased, six-building logistics campus located in the rapidly expanding Greenville–Spartanburg corridor.

Proforma Net IRR of 15.2% and a Net Equity Multiple of 1.7x over a four-year hold

Proforma Net annual average cash-on-cash of 7.7%

Lightstone is co-investing at least 20% of the total equity to ensure strong alignment

Acquired at a 39% discount to replacement cost

Over $8.8 million has been invested into the property since 2015

Get direct access to institutional-grade real estate alongside a cycle-tested sponsor with material co-investment.

📺 UPCOMING EVENT

Join Vincent’s Eric Cantor and Adam Katz for an educational session on analyzing real estate deals and what investors should look for. We’ll cover the latest in the industrial sector before breaking down a real industrial deal. We’ll talk about projected numbers, the potential upside, and potential risks.

12/9 at 11 AM ET.

Brought to you by Lightstone DIRECT.

📰 NOTABLE NEWS

💵 Medline IPO: The medical supply company that has been backed by PE giants such as Blackstone and Carlyle Group is set to begin marketing its IPO next week and is targeting a fundraise of $5 billion, which would be the biggest U.S. public offering so far this year. It is expected to trade on Nasdaq with the symbol MDLN.

🚀 Venture funding roundup: Global venture funding hit $39.6 billion in November, on par with October and up 28% year-over-year, with 43% of that funding going to just 14 companies raising rounds of $500 million or more. AI startups captured 53% of the total, with hardware and fintech startups second and third.

🏡 Starter home sales rise: Homes whose prices fell into the 5th-35th percentile of their respective metro areas saw sales rise by 5% year-over-year, a much higher pace than mid-priced and high-priced homes, as buyers prioritize affordability.

🏢 CMBS delinquencies fall: In a promising sign for the commercial real estate sector, the delinquency rate for commercial mortgage-backed securities fell 20 basis points in November, though the rate is still 90 basis points higher than it was this time last year.

🚀 K2Space fundraise: The satellite startup is raising a new round at a valuation of $3 billion, quadrupling its last valuation from February, as space tech continues to draw investors.

🎨 Miami Art Week: ArtNews has put together a helpful list of the best booths at this weekend’s Miami Art Basel, as well as at the Untitled Art fair and the NADA art fair, as the final major art event of the year gets underway.

Fundrise is America’s largest direct-to-consumer private markets manager, offering individual investors venture capital, real estate, and private credit offerings.**

**sponsored link

📝 IN CASE YOU MISSED IT

Monday: 🪙 Crypto slump, 🏡 Sellers leaving market

Tuesday: 🧑⚖️ Litigation finance struggles, 🚀 Defense tech record

Wednesday: 🏡 2026 housing market predictions, 🥚 $30 million Fabergé egg

Thursday: 🚀 2026 VC outlook, 📊 ADP private jobs report

Have a great weekend!

How would you rate this issue? |