- Alternative Investing Report

- Posts

- Alternative Investing Report - November 8, 2024

Alternative Investing Report - November 8, 2024

Happy Friday. The Fed cut interest rates, Apollo targets individual investors, Sotheby’s is holding an auction in Saudi Arabia, and rents are falling nationally. Let’s dive in!

🎫 Register: For our first Pre-IPO briefing, as we partner with Sacra to analyze payments company Stripe. Monday, November 18 at 11 AM ET. Sign up now!

🎤 Listen: The newest episode of Smart Humans, where we turned the tables on host Slava Rubin and get the skinny on his journey through alternative investing.

Today’s issue is brought to you by Percent, whose private credit marketplace offers potential returns up to 20%.

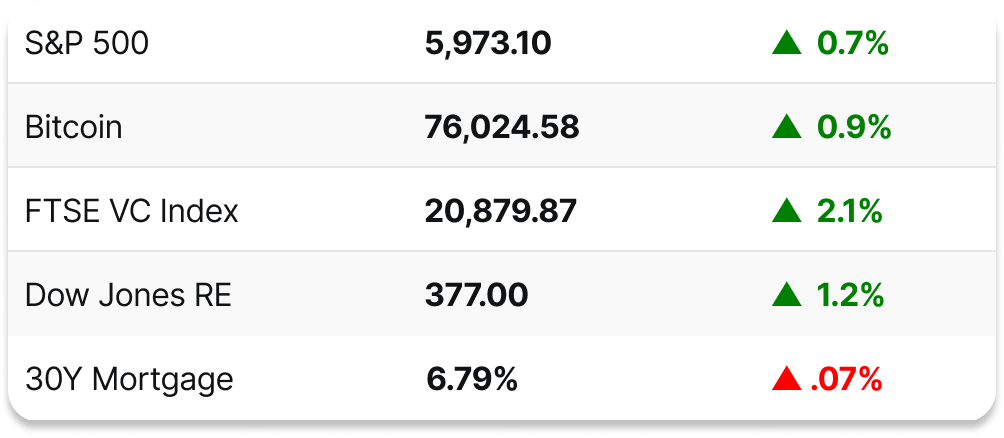

📈 DAILY MARKETS

📊 FED RATE CUT

The Federal Reserve cut interest rates for the second consecutive meeting, following September’s half-point cut with a quarter-point cut on Thursday. The next meeting comes in mid-December, where another quarter-point cut is expected, and the Fed’s September forecast indicated four quarter-point cuts to come in 2025.

➨ TAKEAWAY: This rate cut was widely expected, and had mostly been priced into markets, which are still also reacting to the election of Donald Trump. Because many experts and analysts expect Trump’s policies, particularly his proposed tariffs, to increase inflation, it is unclear whether the Fed will follow through with its 2025 plans. Already, traders are betting that there will be only one or two rate cuts in 2025, so investors may not be able to expect a significantly lower interest rate environment in the near term.

Partner

Explore the Benefits of Private Credit Investing

If you study the capital flows and announcements of the world’s largest asset managers, you’ll notice that private credit has become one of the hottest asset classes of 2024.

With Percent, accredited investors like you can participate in this booming asset class and tap attributes like:

High yield potential (up to 20% APY) plus cash flow from monthly interest payments

The option to redeploy capital frequently with shorter-term investments

A wide swath of deals, ranging from small business loans, merchant cash advances, trade finance, consumer loans, and more across the US, Canada, and Latin America

With the market at all-time highs, many investors turn to private credit because its returns are historically less correlated to public markets, which can stabilize a portfolio during a downturn.

🎫 UPCOMING EVENT

Interested in the state of private companies? Join us on Monday, November 18th at 11 AM ET for the Vincent x Sacra Pre-IPO Briefing. Co-founder Slava Rubin of Vincent and Marcelo Ballvé, Pre-IPO analyst at Sacra, will break down Stripe, the global payments platform last valued at $95 billion. They will discuss the company’s growth, strengths, challenges, IPO prospects, and much more, and answer investor questions to help you form your view on the company’s outlook.

💵 APOLLO TARGETS RETAIL

Alternative asset manager Apollo Global Management is continuing its push to target individual investors, expanding its offerings to high-net-worth and retail investors. It is aiming to simplify its products and offer educational resources to widen its appeal and attract more capital from everyday investors.

➨ TAKEAWAY: Individual investors continue to seek access to private market assets, and Apollo is trying to meet that demand. It recently launched a new evergreen private wealth fund that offers investors access to a wide-ranging private market portfolio. It also recognizes the large, mostly untapped market of retail investors, as it has only been selling its products to 5%-10% of that category.

Cash-flowing rental properties, 100% turnkey: Doorvest offers a unique opportunity to become a landlord and earn passive income without the headache.**

**Sponsored Link

📰 NOTABLE NEWS

🎨 Sotheby’s in Saudi Arabia: In February 2025, the auction house will stage the first ever international auction in Saudi Arabia’s history, featuring local and international art, as well as luxury items including cars, watches, jewelry, handbags, and sports memorabilia.

🏡 National rents decline: The typical asking rent nationwide fell by 0.2% in October, and a record 37.7% of listings are now offering concessions, as demand has slowed and inventory has risen.

🪙 Crypto election success: The industry spent big on political donations this year, and many of their preferred candidates won, setting up the next Congress to be the most pro-crypto one yet.

🚀 CoreWeave IPO prep: The cloud computing company specializing in AI infrastructure selected its banking partners as it lays the groundwork for a highly-anticipated 2025 IPO.

👠 Ruby slippers: One of four known pairs of the famed shoes from the Wizard of Oz has surpassed the $1 million mark at Heritage Auctions, with bidding coming to an end on December 7.

🏢 Blackstone buys ROIC: The alternative asset giant is paying $4 billion to acquire a portfolio of 93 grocery-anchored shopping centers primarily in high-density West Coast cities, as it is clearly bullish on grocery-anchored retail properties and essential services.

📝 IN CASE YOU MISSED IT

Monday: 🪙 Crypto exchanges, 🚀 Tech layoffs down

Tuesday: ✅ Election Day, ⚾ Ohtani memorabilia records

Wednesday: ✅ Election results, 💵 Private credit returns

Thursday: 🏡 Homebuyers report, 📃 Presidential auctions

Have a great weekend!

How would you rate this issue? |