- Alternative Investing Report

- Posts

- Alternative Investing Report - November 6, 2024

Alternative Investing Report - November 6, 2024

Happy Wednesday. The election brought a red wave, private credit funds are leading the way, a Michael Jordan jersey sells for $4.6 million, and a new robotics AI unicorn. Let’s dive in!

🎤 Listen: Revisit this episode of Smart Humans, featuring Anthony Scaramucci and Slava Rubin discussing what the election means for investors.

Today’s issue is brought to you by Doorvest, offering 100% Turnkey Rental Properties with 0% of the work.

📈 DAILY MARKETS

✅ ELECTION RESULTS

Former President Trump will return to the White House after a dominating election-night performance concluding around 5:30 AM this morning. Betting markets were heavily favoring former President Trump for the past week, but such a lopsided outcome was surprising to many. Votes are still being counted, but in addition to the White House Republicans look poised to win the popular vote and Senate, and are also likely to capture the House.

➨ TAKEAWAY: In response to Trump’s victory, financial markets appear poised to see significant gains when they open. The crypto market popped, as many believe that a Trump presidency will be strong for the industry, and Bitcoin surpassed $74,000 and zoomed past its all-time high. S+P futures surged overnight as well. It might be a few more days before the electoral outcome becomes clearer, but early signs suggest that the investing climate will continue its recent improvements.

Partner

100% Turnkey Rental Properties - 0% of the Work

As a landlord, there’s nothing worse than a 3 AM call from one of your tenants.

Why are they up so early? Doesn't matter - it’s your job to make sure their needs are met.

Or, you could make it Doorvest’s job. Their platform gives you the opportunity to become a landlord (or expand your existing portfolio) and earn passive income without the headache.

They handle everything end-to end:

Selecting the best market

Sourcing investment property

Connecting you with financing options

Renovating the property

Selecting property management

Finding tenants

Managing the day-to-day

All you have to do is collect your check.

Browse Doorvest’s marketplace of cash-flowing rental investments.

🎤 PODCAST

In this episode of Smart Humans, SkyBridge Capital’s Anthony Scaramucci joined Vincent co-founder Slava Rubin to discuss the election’s impact and his investment predictions, including how high he thinks Bitcoin will go.

💵 PRIVATE CREDIT

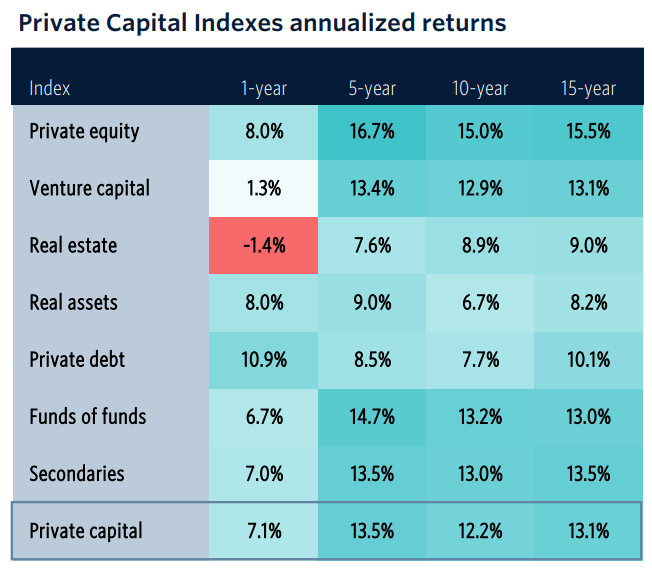

(Pitchbook)

Across active, closed-end funds, private credit has been the best performer over the past year, returning 10.9% and outpacing asset classes such as real estate, private equity and venture capital. It returned an average of 4.2% in Q2, with direct lending funds performing particularly well with an 8.7% return, the highest of any type of fund. It has also been the least volatile asset class since 2000, compared to venture capital and real estate, which rank as the top two most volatile assets.

➨ TAKEAWAY: Private credit has attracted a lot of investment as the higher interest rate environment has boosted returns, particularly with its reputation as a relatively safe and stable asset class. There have been concerns about the lack of transparency within the $2 trillion market because funds do not have to disclose data about underperforming loans in their portfolios. Additionally, some private credit borrowers have started to default or need to restructure their loans. Investors should be aware that an asset class with the lowest volatility leading in returns might not be sustainable going forward.

Discover the benefits of working with a trusted financial advisor. Join the legions of individuals who trust Money Pickle to get the personalized advice they need to thrive.**

**Sponsored Link

📰 NOTABLE NEWS

🏀 Michael Jordan jersey sells: A game-worn jersey from the 1996-97 season sold for $4.68 million at Sotheby’s, within the pre-sale $4 million - $6 million estimate. Worn in 17 games by the GOAT, it becomes the 4th most expensive NBA jersey of all-time.

🤖 Physical Intelligence raise: The Robotics AI startup raised $400 million at a $2 billion valuation, led by Jeff Bezos, Thrive, and Lux Capital. The company had previously been valued at $400 million in March, with this round representing another example of exponential growth for an AI startup this year.

🪙 Global Dollar stablecoin: Another stablecoin, the Global Dollar (USDG), has been launched by Paxos and backed by Robinhood and Kraken. The big differentiator between USDG and its competitors like Tether (USDT) and USDC is that users can earn yield on their holdings.

🚜 Decline in U.S. farmland: As of the end of 2023, there were 53.1 million acres of irrigated farmland in the U.S., down 4% from the total in 2018. Declining supply of farmland is likely to continue pushing prices up.

🚀 Slow fundraising for small funds: Only 118 small and midsized VC firms have raised new funds this year, the fewest since at least 2017, though there is historical data showing that funds that are able to raise in difficult environments outperform their peers.

🎨 Picasso at Sotheby’s: The Spanish legend’s 1949 painting “Buste de femme” has been added to Sotheby’s Evening Sale on November 18, and carries an estimate of $9 million - $12 million.

🪙 CRYPTO MARKET MOVER

Coin: Popcat (POPCAT)

Price: $1.29

Price change last 7 days: -25.7%

The Solana-based cat memecoin, which saw big gains last week and hit an all-time high, has come back down to Earth, posting the biggest decline of any token in the top-100 by market cap. Just as there was no inciting incident for the rise in price, there does not seem to be a catalyst for the fall. Memecoins, which have no use case or inherent value, are inherently volatile, and anyone investing should consider that there can be massive short-term swings.

How would you rate this issue? |