- Alternative Investing Report

- Posts

- Alternative Investing Report - January 23, 2026

Alternative Investing Report - January 23, 2026

Happy Friday. Noel Moldvai gives us a private market investing pick, CapitalOne bought Brex, OpenEvidence doubled its valuation, and the office market is bouncing back. Let’s dive in!

🎫 Register: For our next pre-IPO briefing on the $20 billion AI search engine startup Perplexity. January 28 at 11 AM ET.

This issue is brought to you by Augment, whose Collective funds are the easiest way to invest in the most popular private tech companies.

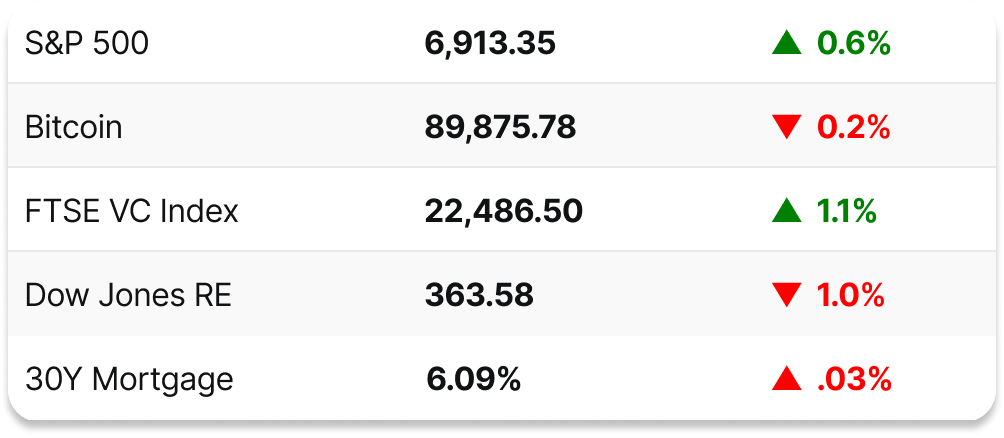

📈 DAILY MARKETS

✅ PICK OF THE WEEK

xAI

Most recent known valuation: $250 billion (post-money)

I love Elon Musk, so I picked something in his realm

xAI is interesting and I think they are going to be a real competitor in the space

I think xAI, SpaceX, Tesla (Elon’s companies) are all going to work together and be greater than the sum of their parts

Here’s a list of our past expert investing picks. In March 2025, Anthony Scaramucci also picked xAI when it was at a valuation of $113 billion - that pick has more than doubled in value in less than a year.

How do you feel about today's pick? |

👨🏫 TODAY'S EXPERT

Noel Moldvai is co‑Founder and CEO at Augment, a pre‑IPO investing platform making private markets liquid, transparent, and accessible. Under Noel’s leadership, Augment scaled from launch to an 8-figure run rate in 18 months profitably, raised $17M, and surpassed $750M+ in AUM. Prior to Augment, Noel was an engineer at Google and an engineering leader at Rubrik, where he helped bring Rubrik’s on‑prem technology to the cloud and experienced the challenge of employee liquidity firsthand. Noel has a degree in Electrical Engineering and Computer Science from UC Berkeley, grew up in Eastern Europe and the Bay Area, and is now settled in Austin.

📺 UPCOMING EVENT

Join Vincent co-founder Slava Rubin and Sacra co-founder Jan-Erik Asplund for an in-depth session on Perplexity, one of the world’s most innovative AI startups. They will talk about how Perplexity is changing the search engine game, its IPO prospects, and its competitors. 1/28 at 11 AM ET.

Presented by Augment, whose Collective funds are the easiest way to invest in the most popular private tech companies.

📰 NOTABLE NEWS

🚀 CapitalOne acquiring Brex: The credit card powerhouse is buying the payments startup for $5.15 billion, a significant discount to its $12.3 billion valuation from 2023, but an exit that will provide liquidity and profits to its early VC backers.

🤖 OpenEvidence fundraise: The so-called “ChatGPT for doctors” raised a $250 million funding round at a valuation of $12 billion, double its valuation from just three months ago and 12x from its $1 billion valuation from one year ago.

🏢 Office recovery continues: While office visits are still significantly below pre-pandemic levels, they reached their highest December level since the pandemic, nearly doubling where they were in 2021. While it is unlikely that foot traffic will return to 2019 levels, it is clear that return-to-work mandates are helping the sector in its recovery.

🏡 Top luxury markets: Based on factors that include supply and demand strength, economic health, and quality of life, the Detroit metro area takes the #1 spot for luxury housing, followed by St. Louis and San Diego.

🪙 Crypto generation gap: While 40% of Gen Z and 41% of Millennials reported in a new survey that they have a high level of trust in crypto, only 9% of Baby Boomers said the same. This is not a particularly surprising result, but does speak to crypto’s potentially positive long-term outlook.

⚾ Another T206 Wagner on sale: While one T206 Honus Wagner card has currently surpassed $4 million at Goldin Auctions with a month left before the end of the sale, another is coming to Heritage Auctions in March with pre-sale estimate of $3 million. The grail baseball card — printed in 1909 — last sold in 2021 for $2.52 million, and famously, no T206 Wagner has ever sold publicly at a loss.

📝 IN CASE YOU MISSED IT

Monday: 🚀 2025 VC recap, 🤖 Ads in ChatGPT

Tuesday: 🏢 Data center demand, 🪙 Crypto slide

Wednesday: 📉 Tariff dip, 🎨 Western Art auction

Thursday: 💵 Private credit wanes, 📉 Pending home sales drop

Have a great weekend!

How would you rate this issue? |