- Alternative Investing Report

- Posts

- Alternative Investing Report - January 22, 2026

Alternative Investing Report - January 22, 2026

Happy Thursday. The private credit boom is waning, pending home sales plummeted, Strategy made a big Bitcoin buy, and a drone startup raised a huge round. Let’s dive in!

🎤 Listen: To our 2026 preview, where Slava Rubin and Adam Katz discuss the year ahead for the real estate market, and which cities are worth looking into.

This issue is brought to you by Masterworks - invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso.

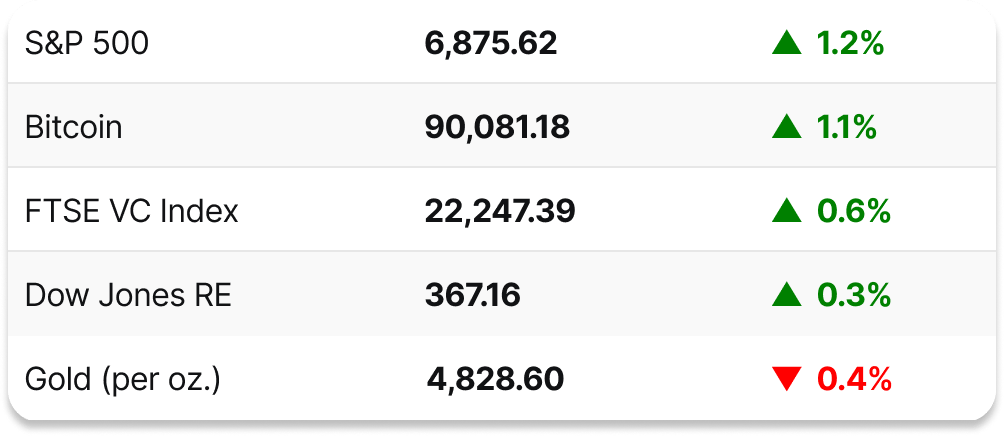

📈 DAILY MARKETS

💵 PRIVATE CREDIT

Major private credit firms are seeing increased redemption requests by investors, with more than $7 billion withdrawn from funds managed by the likes of Apollo, Ares, Blackstone, Blue Owl, BlackRock, and others in Q4. However, many firms are still successfully raising large funds, even as warning signs in the asset class continue to mount. Additionally, firms are now turning to retail investors, with that market expected to grow by as much as 30x by the end of the decade.

➨ TAKEAWAY: This could be the first sign that institutional investors are growing wary of private credit, as the market has become overcrowded and loan quality has declined over the past year. The bankruptcies of auto parts company First Brands and and auto lender Tricolor also gave investors reason for pause. As firms turn to retail investors to fill the gap, it is worth wondering why more sophisticated investors are starting to turn away from the asset class.

Partner

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

🎤 PODCAST

“Multifamily...in core metro areas, I think that's my number one.”

In this mini-episode of Smart Humans, Vincent co-founders Slava Rubin and Adam Katz analyze the current state of the real estate market, mortgage rates, and investment strategies, and provide insights into which markets to be bullish or bearish about in the coming year.

📰 NOTABLE NEWS

📉 Pending home sales fall: Despite a decline in mortgage rates, pending home sales fell 9.3% in December with a 3% decrease year-over-year, as the housing market is still waiting for an increase in activity.

🪙 Strategy buys $2 billion of BTC: Michael Saylor’s original digital asset treasury bought 22,000 Bitcoin, to add to its hoard of more than 700,000. The company’s average purchase price is just under $76,000, making that number ia mark to watch. If the price gets anywhere close to that, it could spell trouble for Strategy and the broader market.

🚀 Zipline fundraise: The drone delivery startup raised a $600 million funding round at a $7.6 billion valuation, nearly double its previous valuation of $4.2 billion from 2023.

💵 Dry powder rises: Private market funds hold more than $4.6 trillion of investable capital, a 4.6% gain year-over-year, with the vast majority of the growth going to private equity.

🏡 More sellers than buyers: There are now 47% more sellers than buyers in the housing market, the highest differential since at least 2013, when the statistic was first tracked. This imbalance is largely driven by buyers disappearing from the market due to affordability concerns.

👀 Eye appeal in collectibles: The way an item looks plays an enormous role in how valuable it is, with big variations even for sports cards, comic books, coins, and game-used items that carry the same grade.

🤖 AI CORNER

AI has been dominating the discourse at the World Economic Forum in Davos, Switzerland, with major CEOs and world leaders talking about how the technology could shape the future, and the risks and upsides it presents. Nvidia CEO Jensen Huang focused on the AI robotics industry and the amount of infrastructure that needs to be built worldwide to support the sector. Anthropic CEO Dario Amodei criticized Nvidia and the American government for making a deal with China to allow AI chip sales in the country. Microsoft CEO Satya Nadella talked about the need for AI to justify its immense energy usage before the tides of public opinion turn against it. All of these commentaries reinforce the prominence AI now has on the global stage when the most powerful people in the world are spending their conference discussing it.

How would you rate this issue? |