- Alternative Investing Report

- Posts

- Build a diversified private credit portfolio

Build a diversified private credit portfolio

How to build a diversified private credit portfolio

(Morgan Stanley)*

The private credit market has been booming, with the size of the market growing by 50% since 2020 and projected to nearly double by 2030. Both institutional investors and retail investors have been rapidly increasing their exposure to the asset class in the past few years. Over the past ten years it has outperformed public debt options and other private market options when its returns are compared to its volatility.

Private credit is essentially what it sounds like - any lending or debt arrangement in which one of the parties involved is a private entity, often the lender. Private credit helps borrowers such as companies, real estate developers, or even individuals, get access to capital, while allowing lenders to earn higher returns than they would with traditional debt offerings.

Why Invest in Private Credit?

There is a reason why institutions and high net worth investors have been increasing their allocations to private credit over the past few years. It offers the potential for higher returns than the public debt market, while maintaining a similar risk profile that is generally less volatile than equities or other private market asset classes. It acts as an interest rate hedge, as certain strategies have historically shown stronger performance in higher-rate environments. The strategies often make periodic distributions, typically monthly or quarterly, providing a source of cash flow and passive income.

Of course, with higher returns, there is more risk, as borrowers turning to private options may have poor credit or lack collateral, and some will be unable to make their payments and will end up defaulting on the loan. If the loan is priced appropriately, the risk of default is generally tied to the rate of return - the higher the risk, the higher the interest rate borrowers will have to pay to compensate for that risk. In an economic downturn, the risk of default will be higher, but it is important to note that private credit, especially experienced fund managers, has weathered previous recessions more effectively than many other asset classes.

For individuals, investing in private credit can be difficult as most people don’t have the time or resources to invest in individual loans or funds, or act as a private lender themselves. Like any investing strategy, building a diversified portfolio is a key principle in a sound strategy, but it can be hard to access institutional-grade deals and find quality credit managers.

How can you invest in private credit?

As an individual investor, there are a few options to get exposure to private credit, assuming that you are not going to source and diligence individual loans. When considering the different options, key criteria to look at are the experience of the credit manager, the historical track record of returns and volatility, and the diversification of the portfolio.

Private credit investing options include:

Private credit funds, which often have prohibitively high minimum investments, if they are even open to individual investors.

Online platforms that can be accessed by retail investors but carry more volatility and platform risk.

ETFs, which are available to anyone, but they are not entirely made up of private credit assets, and their fees can be high relative to their return potentials.

Finally, there is Heron Finance, which offers individual accredited investors the ability to access a diversified portfolio of loans sourced from multiple private credit managers, potentially enhancing diversification and helping to mitigate concentration risk.

Who is Heron Finance?

Heron Finance was founded in 2023 with the aim of bringing private market access to individual investors, and giving them exposure to institutional-quality investments. Starting in the private credit space, Heron has grown to include 12+ leading private credit fund managers in their portfolios. Its next step is to expand into the private equity world and allow investors to increase their exposure to high quality private market assets.

Prior to founding Heron, co-founders Mike Sall and Blake West founded Goldfinch, a blockchain based credit protocol that has facilitated more than $110 million in private loans across dozens of markets. Chief Credit Officer Khang Nguyen has nearly two decades of private credit research and investment experience, and has structured, deployed, or advised on more than $20 billion in private credit transactions.

Heron has been featured in media outlets such as Bloomberg, Benzinga, Nerdwallet, Yahoo! Finance, and more.

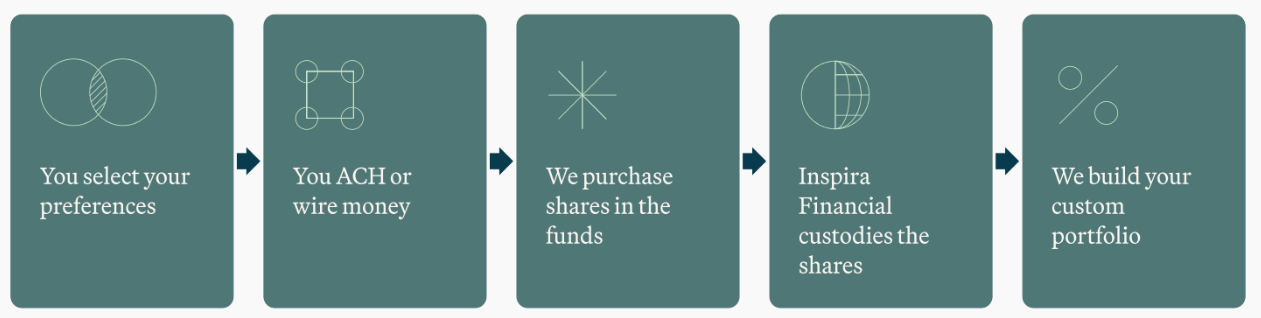

How does it work?

Heron has simplified the process of creating a personalized portfolio, starting with a short quiz to determine your investing preferences and needs. Next, you can choose between a standard account and an IRA account, and add funds via an ACH or wire transfer. You can start earning monthly income, which can automatically be re-invested, and your portfolio can be adjusted over time as additional deposits are made.

Why invest with Heron?

Leveraging their team’s decades of experience in the sector, Heron’s private credit investments have been outperforming their peer group. An analysis of SEC filings as of Q2 2025 from more than 60 of the largest U.S. private credit funds, shows that the funds available in Heron portfolios delivered an average 9.7% return (net of fees) versus 7.5%.** That level of return has also come with lower volatility and a lower default rate than the competition. Investors get access to a personalized portfolio that is made up of assets from 12 funds that hold more than 3,000 different private credit loans. The passive income generated from that portfolio can automatically be reinvested to support compounding over time, while the portfolio is regularly monitored and rebalanced in accordance with the selected strategy.

To build an investor’s portfolio, Heron evaluates and ranks private credit funds, using its proprietary model to assign a quality score based on the general riskiness and overall quality of the fund. It prioritizes funds with ten or more years of performance across multiple market cycles, with an emphasis on experience navigating prior downturns. Funds generally have sizable AUMs and show consistent returns and distributions, with a high percentage of first-lien loans and low default rates. Heron tracks the historical returns of each fund and estimates its risk-adjusted performance. For its investors’ portfolios, Heron seeks to select funds that rank highly within this framework and conducts ongoing reviews to assess whether they continue to meet its criteria. And it’s easy to keep track of your holdings, with a simple, intuitive dashboard that shows your portfolio in detail, including a list of all loans and expected payments.

For illustrative purposes only.

Heron keeps its investments accessible with a $5,000 minimum initial investment and a low 1% annual management fee that is automatically deducted from returns. If they are in need of liquidity, investors can request a redemption any time and can be fulfilled once a quarter, giving people flexibility in a historically illiquid asset class. Heron is also a registered investment adviser.

There are always risks involved in investing, and particularly in private market investing and in the private credit sector. As previously discussed, the risk of default is always present when dealing with private loans, and an economic downturn could make it difficult for borrowers to repay in full. However, a diversified portfolio of loans does help mitigate that risk, as does choosing high-quality credit managers to invest in. As such, Heron’s model is designed to provide investors with thoughtfully built private credit portfolios aiming to minimize risk and enhance returns.

“As an economist, I value diversification. Heron Finance has expanded my portfolio beyond stocks and bonds into private credit—and within that space, diversified across high-quality funds. The returns have been very good and Heron Finance is now part of my long term financial strategy.” - Alex Tabarrok, Chair in Economics, George Mason University***

Heron Finance provides investors with an accessible way to build diversified portfolios with private credit, which has outperformed high yield bonds and the S&P 500 in recent years. And with the company expanding into private equity, it will soon deliver another private market asset class to individual investors.

*Image sourced from https://www.morganstanley.com/ideas/private-credit-outlook-considerations, data represents the 10-year period from 1Q ’15 to 1Q ’25. All private market categories are represented by PitchBook’s Private Capital Index of closed-end fund returns, net of fees, for the corresponding strategy. Calculated from quarterly data which has been unsmoothed and annualized.

**Dataset source: SEC filings for June 2025. Dataset includes over 60 of the largest U.S. private credit funds, which are actively managed by firms that collectively manage in excess of $1 trillion in private credit assets across their funds and accounts. Percentages shown as medians. Funds on Heron includes funds being made available through Heron as of August 2025. Peer group includes all funds in the dataset but excludes Heron funds. Total Returns shown as annualized Q2 2025 IRR after Heron fees.

***Testimonials are based on unique experiences from current clients and are not representative of all client experiences. No cash or non-cash compensation has been provided.

Disclaimer: This is a paid placement and is not financial, investing, or tax advice. Investing involves risk, including the loss of principal. Private credit is subject to credit, liquidity, and interest rate risk. Past performance does not guarantee future results. Heron Finance is not affiliated with the private credit firms mentioned. The information in this placement is for informational purposes only.