- Alternative Investing Report

- Posts

- Investing in Energy Infrastructure

Investing in Energy Infrastructure

Investing in Energy Infrastructure

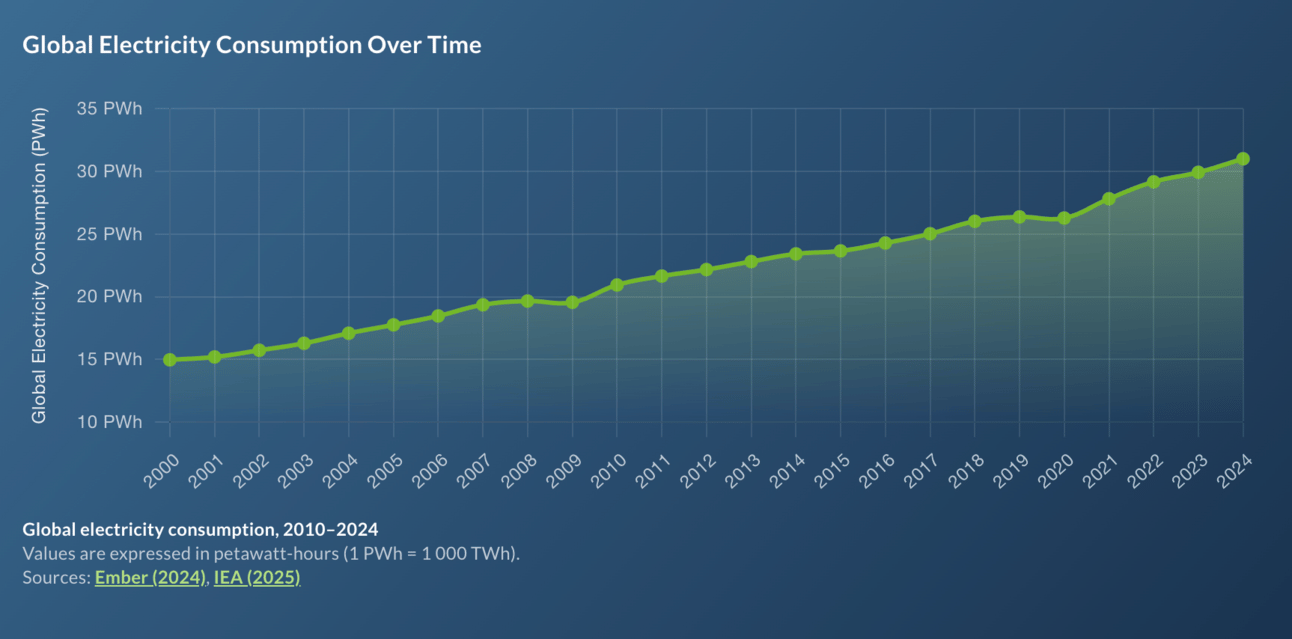

Simply put, the world needs more energy production. Global electricity consumption has doubled in the past twenty years, and the rate of growth is accelerating. The rise of AI and its data centers, electric cars, and growing climate-related demand for cooling and heating worldwide will only add to the load on the electric grid. In order to meet the need for more production, energy infrastructure projects are being built worldwide to help meet demand.

With these projects come investment opportunities - there’s a reason that Larry Fink, the Chairman and CEO of BlackRock, the massive alternative investment firm, focused on infrastructure investments in his recent investor letter. It is estimated that global infrastructure investment needs will exceed $100 trillion by 2040, with energy infrastructure requiring more than $4 trillion annually.

Why Invest in Energy Infrastructure?

Infrastructure investments can be a very attractive addition to any investor’s portfolio, as they deliver passive income in the form of dividends, and the returns are steady and generally uncorrelated to equity and fixed income markets. Energy powers the global economy, and is an essential service, meaning that demand will always be there regardless of the overall market situation. Energy prices also tend to rise with inflation, making it a particularly strong inflation hedge. Infrastructure projects also require a large upfront investment - these costs along with the complexity of projects limits competition and protects long-term revenues, making energy infrastructure a reliable source of passive income for investors.

Energy infrastructure has become particularly popular in recent years, with solar power seeing rapid growth and substantial investment. Its specific characteristics make it straightforward to invest in, as it’s widely deployed, understood, and supported by clear regulatory frameworks. Once built, solar projects often run for decades, with long-term contracts locking in cash flows that rise with inflation.

It’s no surprise that institutional investors are pouring money into infrastructure investments, with real asset funds nearly doubling their fundraising in Q1 2025. Retail investors have long been excluded from this asset class, with their only option being publicly-traded energy companies and a handful of infrastructure REITs. Energea provides a private market solution to give everyday investors access to institutional-grade deals.

How does it work?

Once a solar project is approved by Energea’s investment committee, funds are raised to construct or purchase it. Investor capital is either spent upfront on construction costs or goes directly towards acquiring an already operational asset. Once completed and energy production begins, the projects generate revenue by selling electricity, generally under long-term contracts. That revenue pays for operating expenses and administrative expenses, with the remaining profits then distributed to shareholders on a monthly basis.

Who is Energea?

Energea is an investing platform that allows everyday investors access to revenue-generating energy infrastructure projects. Founded in 2017 by Mike Silvestrini and Chris Sattler, the platform first opened to investors in 2020. Since then, they have deployed $452 million of total deployed capital across hundreds of projects around the world with a realized 12.07% Internal Rate of Return (IRR).

Mike has extensive experience in the renewable energy field, developing over 500 solar projects in the U.S., Africa, and Brazil, and was the CEO of Greenskies Renewable Energy, one of the country’s largest commercial and industrial solar firms. Chris founded North American Power, a deregulated energy supply company that had over 1 million customers, and was acquired by the largest energy generation asset owner in North America. The team has decades of experience in the energy industry and uses their deep industry connections to source renewable energy investments worldwide.

Current Investment Opportunities

Energea currently offers three different funds to investors that were launched in 2020 and 2021. All of the portfolios are backed by long-term electricity contracts, which ensures that consistent, monthly distributions of profits are paid out to investors.

This fund has a realized IRR of 14.0% since the portfolio launched in 2020, with dozens of projects mostly in southeastern Brazil. 25 of those projects are now operational and are generating electricity and revenue. It averaged a 5.7% dividend yield over the past twelve months.

This fund has a realized IRR of 9.9% and has 14 operational projects primarily in South Africa. It averaged a 6.2% dividend yield over the past twelve months.

This fund has a realized IRR of 7.1% and has 5 operational projects in California and the Northeastern U.S. It averaged a 5.3% dividend yield over the past twelve months.

Energea also offers the ability to easily invest in all three funds and choose the appropriate allocation based on your own financial needs. This product is called Energea Core, and it maximizes diversification and minimizes risk.

Why invest with Energea?

Energea offers access to the energy infrastructure asset class to all investors, accredited and non-accredited, with minimums starting at just $100. Energea investors have consistently earned double-digit IRRs, net of fees, for the past five years, and receive monthly cash distributions. Its platform is straightforward and transparent, and its user-friendly dashboard makes it easy to initially invest and track your investments. It also offers the option of tax-advantaged investing via the Energea IRA.

Energea does extensive due diligence in identifying and vetting projects to ensure that every investment meets their overall criteria. It then oversees and employs the personnel who manage all daily operations of their portfolio of projects. Energea also acquires new projects and has the ability to sell existing projects when it benefits the portfolio.

While energy infrastructure investments are designed to be held long-term, and the minimum hold time of Energea’s investments is three years, liquidity options are available. Investors can sell shares any time (after 60 days), and if it is before that three year period, there is a 5% early exit penalty. Energea updates the net asset value (NAV) of each portfolio daily and pays out based on that NAV. The average turnaround time to sell shares has been between 10 - 12 days.

“I'm incredibly skeptical of stocks and investing in general. What sold me on Energea was that they put all the possible risks and fees up front and center on their website instead of hiding them in the legalese like I've seen some firms do. In addition, they reached out to me to make sure that I was informed and sent me regular invitations to meetings and honest progress reports every month. That level of transparency and respect made them my first non-certificate investment.” - Actual Energea investor

Diversify your portfolio with solar energy investments

The world’s energy needs are only getting higher, and demand for renewable energy sources is growing exponentially. Energea gives everyone access to an uncorrelated, cash-flowing investment that provides passive income and diversification at low minimums.