- Alternative Investing Report

- Posts

- Crypto Beyond Bitcoin

Crypto Beyond Bitcoin

Upcoming Event

Crypto has had a downturn in the past few weeks, which is why it matters more than ever to stay informed.

To learn more about the space, recent market developments, and why now might be a great buying opportunity, join Grayscale’s head of research Zach Pandl for Grayscale’s monthly crypto briefing. December 2 at 4 PM ET.

Along with Zach, we also held an investor briefing featuring Vincent founder Slava Rubin and Fundstrat’s head of digital strategy Sean Farrell that focused on the crypto ecosystem.

Learn more about Grayscale and its products and what could be the best fit for you.

Crypto Beyond Bitcoin

Since Bitcoin’s introduction in 2009, crypto has exploded into a multi-trillion dollar asset class that has been adopted by everyday and institutional investors alike. Bitcoin has been the dominant token within the asset class, currently accounting for just under 60% of the total market capitalization of the entire market. And with its return of 27,000%+ over the past decade, it has brought attention to its own market as well as the rest of the sector. The top three crypto exchange-traded products (ETPs) are Bitcoin trusts, and they account for 70% of the total crypto ETP market.

There is a thriving ecosystem beyond Bitcoin, with major tokens such as Ethereum, XRP, and Solana, and a number of other tokens with compelling use cases that could make them attractive to investors.

Crypto sectors

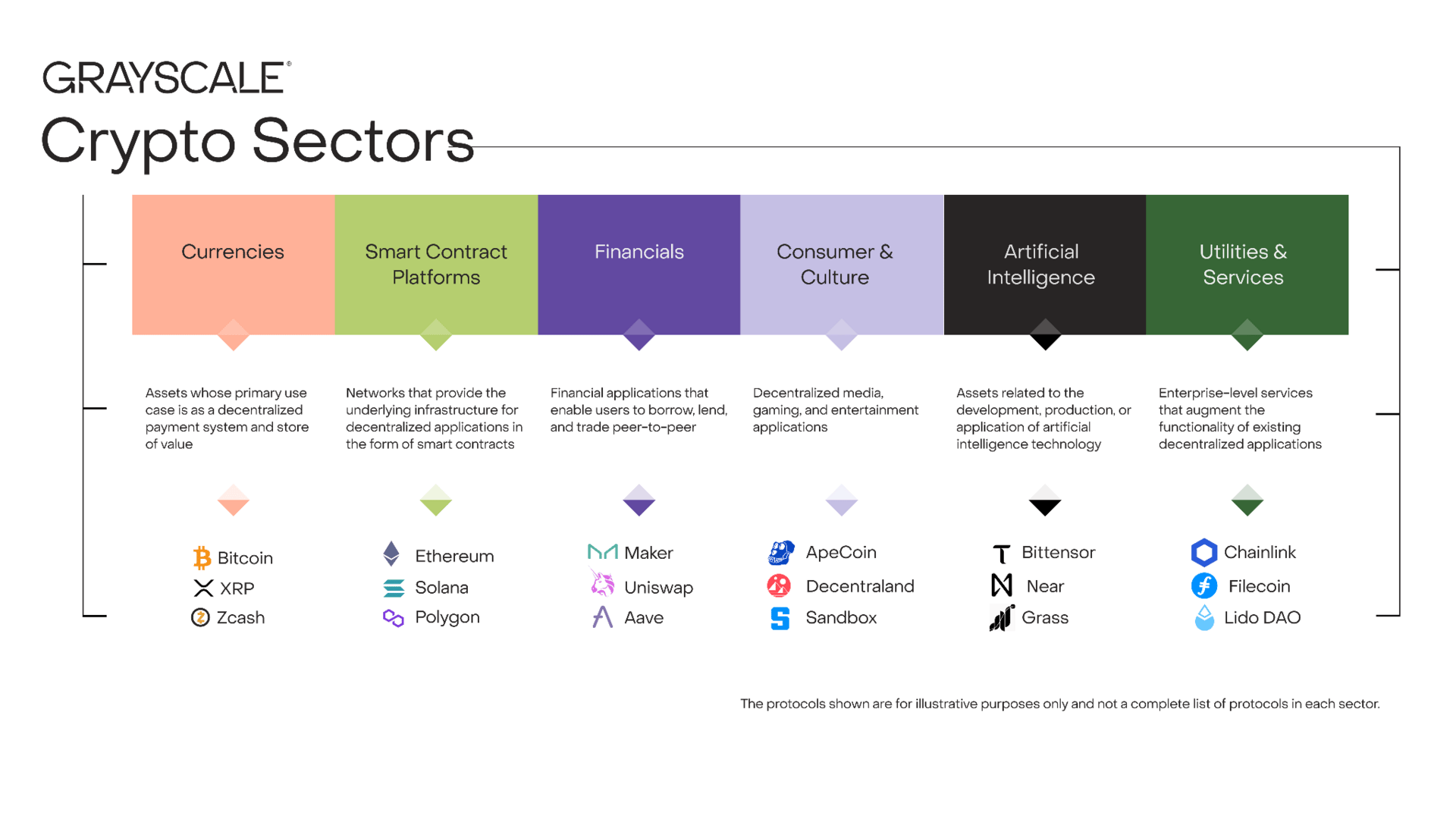

There are more than 50 million unique tokens, and while the vast majority of them are inactive, the crypto world can be overwhelming. The crypto asset manager Grayscale, along with the index provider FTSE Russell, has divided up the world of tokens into six sectors - currencies, smart contract platforms, financials, consumer & culture, AI, and utilities & services. These sectors all serve different purposes within the ecosystem and ultimately should be evaluated differently.

In Q3, Bitcoin actually underperformed the other sectors, with potential reasons including the proliferation of Digital Asset Treasuries (DATs), rising exchange volumes, and the growing stablecoin market.

Stablecoins

Stablecoins are a crypto token pegged to a different asset, most commonly the U.S. dollar, and are designed to help facilitate transactions between the worlds of crypto and traditional finance. Stablecoins can be used globally, are instantly settled 24/7, and have already changed the way people and companies make payments.

The stablecoin market has nearly tripled in size in the past two years, with the market cap now above $300 billion, with Tether and USDC making up the vast majority. That market cap has the potential to reach into the trillions as more companies, banks, and even governments look into issuing their own stablecoins. Congress recently enacted the Genius Act, which created a regulatory framework for stablecoins, legitimizing them and providing a roadmap for the future.

The smart contract platforms that host stablecoins stand to benefit from any future growth, and right now Ethereum and Tron dominate the stablecoin landscape.

Tokenization of Assets

Another recent trend that could boost non-Bitcoin tokens is the tokenization of real-world assets, such as real estate, private loans, and even public equities. This process takes the asset and puts it on the blockchain in the form of tokens that represent a share. Similar to stablecoins, tokenization can help bring liquidity to illiquid markets and enables 24/7 trading. If a property is tokenized, anyone could theoretically buy and sell shares without having to own the whole thing. Ethereum is the major blockchain that has been used in tokenization, but Solana, Avalanche, and others stand to benefit if tokenization becomes more common.

How to get access to crypto?

Crypto ownership among Americans has risen dramatically in the past few years, but there are still major roadblocks for most would-be investors. The confusion about how crypto works, how safe it is, and how to acquire it has stopped many Americans from accessing the asset class. Investors can buy crypto in the spot market but custodying your assets in your own digital wallet can be a confusing process for many. Luckily, there are now easier ways to get into crypto than ever before, with multiple crypto exchanges, trading platforms that offer crypto, ETPs, and publicly traded digital asset treasuries.

DATs

DATs are publicly traded companies that accumulate a specific token, so investors can purchase shares that theoretically represent the value of the treasury company’s holdings. The most notable one is Strategy, formerly known as MicroStrategy, led by noted Bitcoin evangelist Michael Sayor. Strategy owns approximately 3% of all Bitcoin in existence, worth somewhere around $50 billion. DATs have created a significant amount of buying pressure, but some argue that they artificially inflate demand.

This year, a lot of DATs have popped up for other tokens besides Bitcoin, with a number for Ethereum and Solana as well as lesser-known coins, making it convenient for investors who want to or have to stick to publicly traded equities. However, they generally trade at values that are inflated compared to the net asset value of the underlying holdings, as investors are willing to pay a premium for access.

This can seem illogical when you can go to many different platforms and buy crypto on the spot market without paying a premium, but for traditional equities funds these DATs can be the only way to get crypto access. For individual investors, it may make less sense, and can introduce an additional layer of risk in an already volatile asset class. With DATs, investors are betting on the crypto token, but also that the risk premium will stay the same compared to the underlying price. In fact, inflows to DATs have dropped by 95% in the past few months, showing that the market may not be interested in the concept long-term.

ETPs/ETFs

Another way for investors to gain access to crypto is by buying shares of digital asset exchange-traded products (ETPs) or exchange-traded funds (ETFs). After years of attempting to navigate the SEC’s regulations on offering crypto ETPs, they were finally launched in January 2024, and now have a total market cap of nearly $150 billion.

ETPs have institutional grade custody and security, so investors do not have to worry about managing their own crypto wallets and keeping track of passwords and keys. In many cases, fees are lower with ETPs than buying on a crypto exchange. ETPs allow investors to put digital assets into any kind of portfolio, whether it’s a retirement or brokerage account, and make it easier when dealing with estate planning and tax planning. These are the reasons large institutional investors have been turning to ETPs, and individuals can see the same benefits.

Who is Grayscale?

Founded in 2013, Grayscale is the oldest and largest crypto dedicated fund manager in the world, with approximately $35 billion in assets under management across a broad range of product types for both everyday and institutional investors. The company is a pioneer in the space, having introduced the first publicly-traded fund, the first Ethereum investment fund, and the first SEC-reporting crypto investment funds.

Why Invest with Grayscale?

Grayscale is one of the largest crypto asset managers in the world, and is an industry leader in building and offering crypto investment products and helping investors navigate the asset class. The company and its team have the longest track record in the space, and offer the broadest set of investable products in the world, all of which operate under established regulatory frameworks.

The asset manager offers Bitcoin, Ethereum, and Solana ETPs, and multiple Bitcoin and Ethereum-related ETFs. For other crypto tokens, they offer a number of publicly traded funds that are available in brokerage and retirement accounts, as well as dozens of private funds that span the crypto ecosystem. Whatever your individual situation is, there is a Grayscale product that is the right fit for you.