- Alternative Investing Report

- Posts

- Alternative Investing Report - September 30, 2025

Alternative Investing Report - September 30, 2025

Happy Tuesday. Vanguard might be embracing crypto, CRE prices are trending up, gold hit another all-time high, and pending home sales rose. Let’s dive in!

🎫 Attend: Today at 2 PM ET, Cathie Wood of ARK Invest and Atish Davda of EquityZen talking about emerging Pre-IPO names at our exclusive investor briefing.

This issue is brought to you by Grayscale, the largest digital asset-focused investment platform in the world.

📈 DAILY MARKETS

🪙 VANGUARD & CRYPTO

Vanguard, whose $11 trillion of assets under management make it the second largest asset manager in the world, is reportedly considering offering its clients access to crypto ETFs. This is a stark reversal of the company’s previous stance on digital assets, and it comes with growing client demand for access to crypto products.

➨ TAKEAWAY: If Vanguard allows its 50 million global clients to invest in third-party crypto ETFs, it could have a massive effect on the crypto market. There will be an increase in ETF inflows and buying pressure, which should send prices higher in the long run. It also will further position crypto as a default investing option for retirement accounts and retail investors, cementing the asset class firmly in the mainstream.

Partner

Invest in your share of the future

Grayscale offers a diverse suite of crypto investment solutions for individual investors, from single asset token exposure to strategically designed thematic exposure.

Also, hear from managing director of research Zach Pandl in Vincent’s Crypto Beyond Bitcoin event from earlier this month.

📺 UPCOMING EVENT

Today at 2 PM ET - A Pre-IPO briefing with legendary investor and CEO of ARK Invest Cathie Wood, EquityZen’s CEO Atish Davda and Sacra’s Jan-Erik Asplund to talk about the next big companies in the pre-IPO market.

🏢 CRE PRICES

(MSCI)

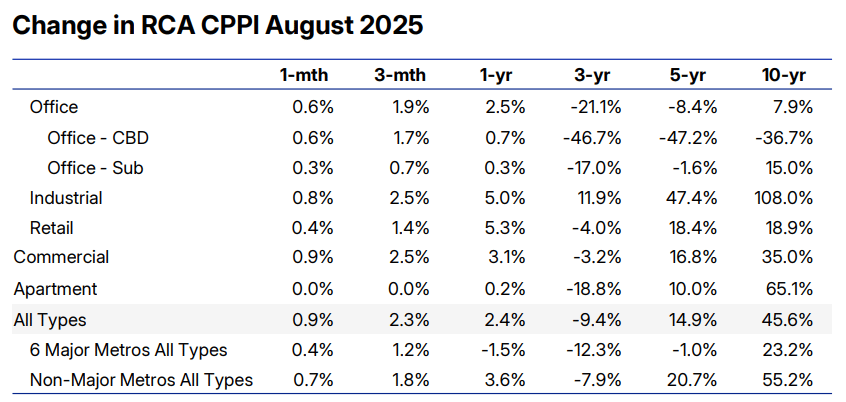

Commercial real estate prices rose 0.9% in August and are up 2.4% year-over-year, according to the RCA CPPI All-Property Index. The annual increase is the highest since 2022, led by retail which rose 5.3% and industrial which rose 5.0%. Office properties edged into positive territory annually, both in urban and suburban areas. Overall, non-major metro areas have outperformed the six major metros — New York, Los Angeles, Chicago, San Francisco, Boston and Washington DC — both for the month and for the year.

➨ TAKEAWAY: The CRE market is trending in the right direction, with all sectors now showing positive annual growth and retail and industrial continuing to perform well. The recent Fed rate cut, combined with the prospect of future cuts should also aid in the sector’s overall recovery.

Pre-IPO opportunities: Wish you’d had access to Circle before it went public? EquityZen clients did. Learn more.

**sponsored link

📰 NOTABLE NEWS

💰 Another Gold ATH: With the U.S. dollar weakening and the possibility of a government shutdown, gold jumped past $3,850 per ounce to set a new all-time high.

🏡 Pending home sales rise: August saw a 4.0% gain in pending home sales, which are also now up 3.8% year-over-year, as lower mortgage rates helped jump start the market. Every region of the country has shown a yearly increase in pending sales, though the Northeast actually saw a monthly decline.

💵 Private credit in emerging markets: There was $11.7 billion deployed in the first half of the year to private credit deals in India, Eastern Europe, and Southeast Asia, which puts 2025 on pace to shatter the record set in 2022.

⚾ Willie Mays auction: The personal collection of the all-time great baseball player netted $6.5 million at a charity auction, including a game-worn uniform that sold for $634,500 and a World Series ring that sold for $458,250.

🪙 Record crypto seizure: A woman pled guilty in the UK to a years-long cryptocurrency fraud that featuring the world’s largest crypto seizure - 61,000 BTC now worth more than $6.5 billion.

🎵 John Lennon’s glasses: A pair of glasses that the Beatles legend wore during his “Lost Weekend” phase is being auctioned next month at Propstore and could sell for more than $400,000.

🏡 LISTING OF THE WEEK

(Zillow)

A 14,000 square foot Bavarian-style castle named “Falkenstein” located two hours north of San Antonio is still on the market after four months. The estate sits on 110 acres, and features seven bedrooms, 4 full and 4 half bathrooms, six additional tiny homes, and of course, a statue of a dragon. The high price tag might put it out of reach for most, but don’t worry, the asking price was just cut by $1 million, dropping it to a mere $14 million.

How would you rate this issue? |