- Alternative Investing Report

- Posts

- Alternative Investing Report - July 29, 2025

Alternative Investing Report - July 29, 2025

Happy Tuesday. The best short-term rental markets in each state were revealed, private equity investors are cashing out, PayPal is embracing crypto, and Anthropic’s valuation could double. Let’s dive in!

🎤 Listen: To the latest episode of Smart Humans, with entrepreneur and investor James Altucher, who talks about the future of crypto and AI.

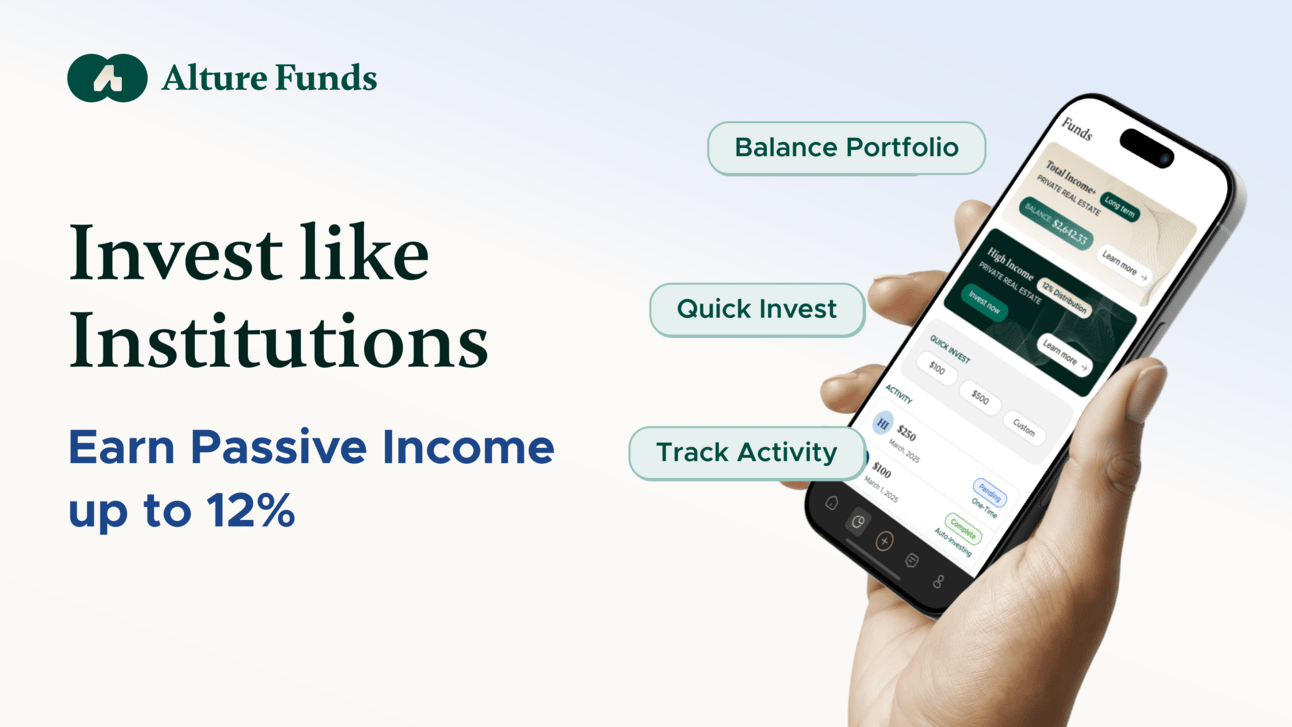

This issue is brought to you by Alture Funds, where you can gain access to institutional private credit offerings with 12% historic annual distributions.

📈 DAILY MARKETS

🏡 SHORT-TERM RENTALS

After a rough couple of years, the short-term rental market rebounded in 2024 and started off 2025 strong, with average daily rates (ADR) rising and occupancy rates exceeding the pre-pandemic average. The real estate website BiggerPockets released a list of the best short-term markets in each state based on ADR, occupancy rates, and a number of other factors. The list includes prominent vacation hotspots such as Sedona, AZ, Joshua Tree, CA, Gatlinburg, TN, Jackson Hole, WY, and of course, Las Vegas. It also includes emerging markets like Gulf Shores, AL, Lafayette, LA, and Tofte, MN.

➨ TAKEAWAY: Short-term rentals are a hybrid of a hospitality business and a real estate investment. Investors need to consider the short-term rental regulatory rules in each market in addition to the usual real estate considerations. With vacation rentals, the neighborhood and its proximity to tourist attractions is of greater importance, as is the decor and amenities. Of course, the best property in the best market is only going to be as good as the operator, but this list of top markets is a good place for potential investors to start their research.

Partner

Gain access to institutional private credit offerings with 12% historic annual distributions

Invest like an institution for as little as $2,500. Access long-tenured, third-party sponsored multi-billion dollar alternative investments via Alture Funds. Open to all investors, regardless of accreditation.

Earn up to 12% passive income with Bluerock High Income Institutional Credit Fund, or invest in 35 real estate partnerships managed by Blackstone, CBRE, Invesco and others through Bluerock’s Total Income Plus Real Estate Fund.

Access institutional grade alternative investments through an app for the first time ever - buy shares in alternative assets with Alture Funds today.

🎤 PODCAST

"I think Bitcoin has a reasonable chance to hit $250K this year or next and $1 million by the end of 2027." - James Altucher

In this episode of Smart Humans, Slava Rubin talks with entrepreneur and investor James Altucher about becoming a successful investor, the impact of AI on the economy, and the future of crypto. Don’t miss James’ investment picks for three years out.

📰 NOTABLE NEWS

🪙 PayPal and crypto: The payments giant is launching a “pay with crypto” service that will allow businesses to accept more than 100 different cryptocurrencies as payment with a lower fee than credit cards.

💵 PE investors opting to cash out: While private equity funds are increasingly turning to continuation funds, their investors are not rolling their investments from one fund to the next, with between 85-92% choosing to sell their stakes this year.

🤖 Anthropic seeking new funding: The AI startup is reportedly in talks to raise a round at a $150 billion valuation, which would more than double its last valuation of $61.5 billion achieved in March.

🎨 Small sales rise: The number of sales of artwork for less than $5,000 grew by 13% in the last year, in contrast to the top end of the art market, which saw sales of $10 million or more fall by 39%.

🚀 Israeli cybersecurity startups: In the wake of Wiz’s $32 billion sale to Google parent Alphabet, North American VC firms have been investing in Israel’s burgeoning cybersecurity scene, with companies such as Cyera and Cato Networks raising megarounds.

🎬 Star Wars auction: One of only six known screen-used Stormtrooper helmets from the original “Star Wars” sold for $256,000 at a Comic-Con auction, alongside a number of other props from the movie series.

Get investment memos on Sequoia, Founders Fund, and Benchmark-backed companies for ~$1 / day: If you want to learn more about venture capital, you should be reading the Confluence.VC guys. Their premium newsletter gives readers early signals on the breakout companies of the future. (Use this link to get 25% off.)**

**sponsored link

🏡 LISTING OF THE WEEK

(LoopNet)

An 8-acre property in Panama City Beach, FL, that formerly housed a marine park called Gulf World is up for sale. It is being marketed as a redevelopment opportunity, which is probably for the best, as Gulf World had a long and controversial history of mistreating its aquatic animals. The lot is part of a bankruptcy sale that could also include the 6-acre Marineland Dolphin Adventure in St. Augustine, FL, and a leasehold interest in the 38-acre Miami Seaquarium, both of which are still operating as businesses. The nature of the sale means the property could be sold at a discount to its $2.3 million assessed value and is being listed without a price.

How would you rate this issue? |