- Alternative Investing Report

- Posts

- Alternative Investing Report - July 22, 2025

Alternative Investing Report - July 22, 2025

Happy Tuesday. Goldman is bringing private credit to 401(k)s, the National collectibles convention kicks off next week, Trump media has $2 billion of bitcoin, and home values are expected to decline this year. Let’s dive in!

🎫 Attend: Today at 11 ET - The Next Wave — investing into energy and climate tech, featuring a powerhouse panel of experts.

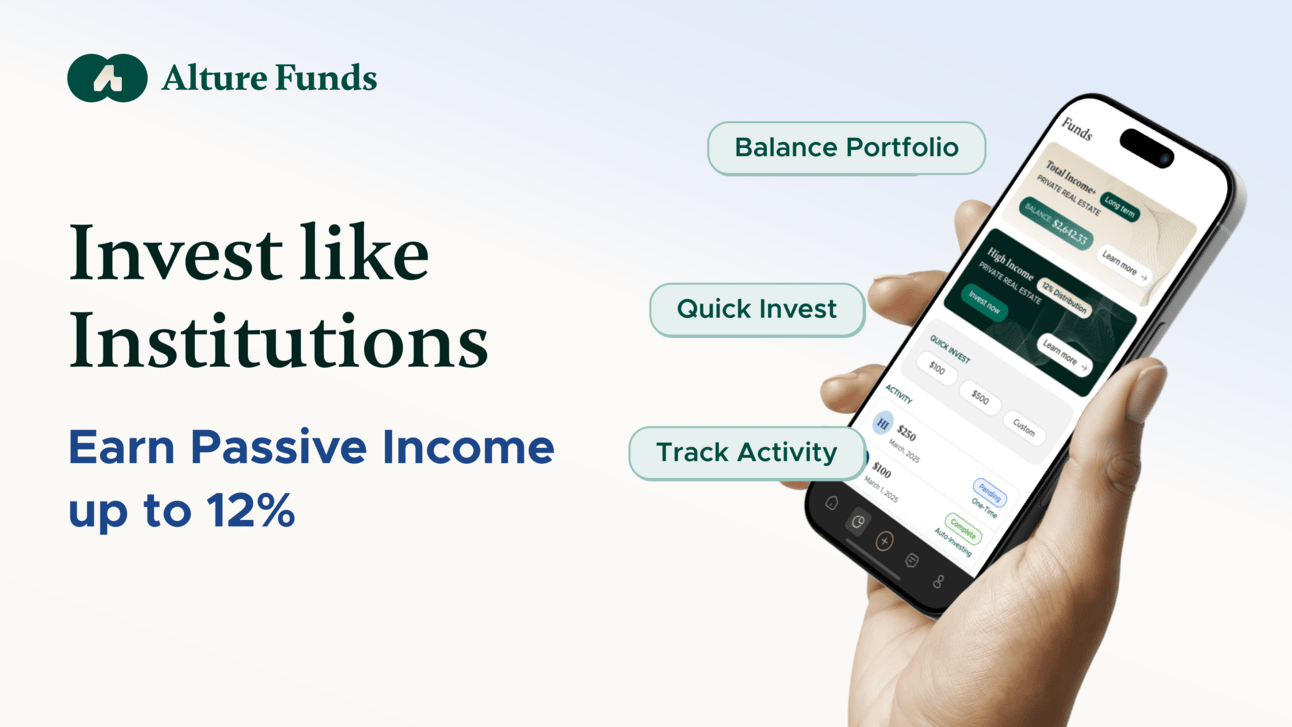

This issue is brought to you by Alture Funds, where you can gain access to institutional private credit offerings with 12% historic annual distributions.

📈 DAILY MARKETS

💵 RETIREMENT PLANS

Another major asset manager is bringing private credit to retirement plans, as Goldman Sachs Asset Management launches a new private credit fund for defined contribution plans such as 401(k)s. The fund will give investors exposure to a broad mix of private credit products and is designed to offer daily liquidity. This comes just after last week’s announcement of Blue Owl’s partnership with Voya which also offers private credit products in retirement plans.

➨ TAKEAWAY: It is probably not a coincidence that Goldman’s announcement comes as President Trump is reportedly considering an executive order to make it easier to include private market assets in retirement plans. The push to bring these assets to individual investors continues, and it is only a matter of time before private credit becomes a standard part of an investment portfolio.

Partner

Gain access to institutional private credit offerings with 12% historic annual distributions

Invest like an institution for as little as $2,500. Access long-tenured, third-party sponsored multi-billion dollar alternative investments via Alture Funds. Open to all investors, regardless of accreditation.

Earn up to 12% passive income with Bluerock High Income Institutional Credit Fund, or invest in 35 real estate partnerships managed by Blackstone, CBRE, Invesco and others through Bluerock’s Total Income Plus Real Estate Fund.

Access institutional grade alternative investments through an app for the first time ever - buy shares in alternative assets with Alture Funds today.

📺 UPCOMING EVENT

Today at 11 AM ET, join our look into the $200 billion energy and climate tech sector and how investors are approaching it, with Energea co-founder Chris Sattler, Zettawatts founder Scott Case, Carbon Collective’s Breene Murphy, and Worth’s Josh Kampel.

⚾ THE NATIONAL

The biggest collectibles event of the year, the 2025 National Sports Collectors Convention, kicks off next Wednesday outside of Chicago. There will be more than 600 booths featuring trading cards and memorabilia of all kinds along with dozens of Hall of Famers and today’s stars from different sports signing autographs. Every major collectible auction house, and many collectibles and grading companies will also have booths at the show. In conjunction with the show, Tom Brady’s CardVault chain of card stores will open up its new Chicago location on August 1st, its sixth location nationwide.

➨ TAKEAWAY: The National has seen increasing interest and attendance ever since the pandemic, and this year’s event is expected to attract more than 100,000 people, which would be the largest thus far. It generates a lot of excitement and hype for the collectibles world, as well as upcoming auctions, and sets expectations for the coming year.

Invest In Energy Infrastructure: Energea offers stable cash flows from contracted, inflation-linked assets and portfolio diversification to reduce risk.**

**sponsored link

📰 NOTABLE NEWS

🪙 Trump Media’s Bitcoin: The President’s media and technology company has accumulated $2 billion worth of Bitcoin, accounting for around two-thirds of the company’s liquid assets.

🏡 Home prices to decline: Zillow projects that by the end of 2025, home prices will have declined 2% year-over-year, as new listings continue to outpace sales.

💵 Venture debt funding: Early-stage venture debt lending is on track to set an all-time high this year as equity funding becomes harder to secure.

🏢 Cap rate compression: The average going-in cap rates for core multifamily properties dropped 6 basis points in Q2, while those for value-add multifamily dropped 8 points. The decline indicates that buyers are willing to accept slightly lower projected returns in order to get exposure to multifamily properties.

🚀 Omega raises new fund: The biotech VC firm raised $647 million for its eighth fund, which will invest in life sciences and drug startups that are targeting unmet medical needs. The raise is a strong sign for a sector that saw funding to startups drop by 20% in Q1.

🥃 One of one auction: Set for October 10, Sotheby’s Distillers One of One auction will feature 40 lots from 36 distilleries that, as the name suggests, are all unique offerings unavailable anywhere else.

🏡 LISTING OF THE WEEK

More than 120 properties are set to be auctioned by the Michigan Department of Natural Resources, including an island on a lake an hour northwest of Detroit. The lots range from under an acre to more than 200 acres, with 15 lots of 40 acres or more. Many have river or lake frontage or are completely forested. The 1-day auctions start on August 1 and run through September 5.

How would you rate this issue? |