- Alternative Investing Report

- Posts

- Alternative Investing Report - July 14, 2025

Alternative Investing Report - July 14, 2025

Happy Monday. An alts platform raised $820 million, the SEC weighed in on tokenized shares, Perplexity is getting into the web browser business, and a big fundraise for a space medicine startup. Let’s dive in!

🎤 Listen: To the latest episode of Smart Humans, where Slava Rubin talks with Energea co-founder Mike Silvestrini about why solar power offers excellent investment opportunities.

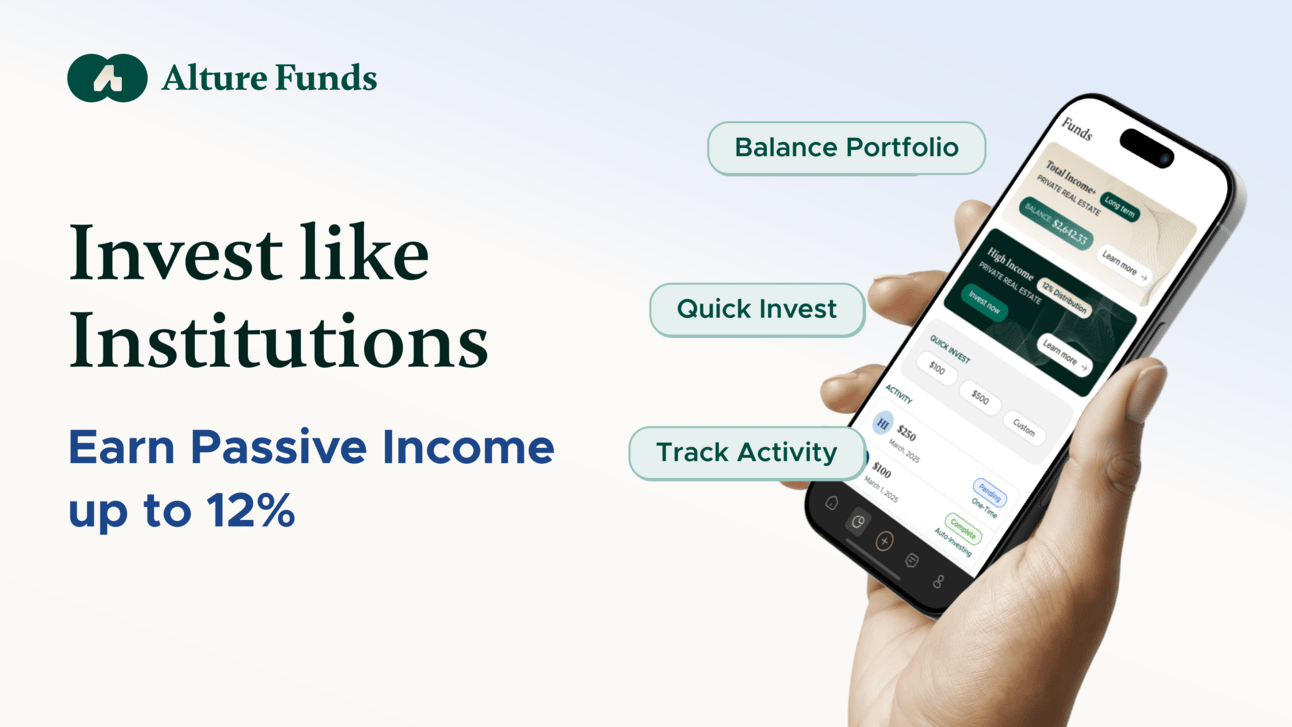

This issue is brought to you by Alture Funds, where you can gain access to institutional private credit offerings with 12% historic annual distributions.

📈 WEEKLY MARKETS

💵 ICAPITAL RAISE

The alternative investing platform iCapital raised $820 million in a new funding round that values the fintech startup at $7.5 billion, up from its last valuation of $6 billion back in 2021. The financing comes on the heels of an announced partnership with BNY Mellon to offer its clients more exposure to alts. iCapital has more than $945 billion of global assets on its platform, which helps wealth managers invest into private markets. It also offers services to asset managers to help with sales and data management.

➨ TAKEAWAY: Alternative assets continue to make up a bigger part of the investing world, with more asset managers bringing more private options to their clients and family offices adding them to portfolios. The expansion of platforms like iCapital will only bring alts to more investors. It should help that private markets outperformed public markets in Q1, led by private credit and funds of funds strategies.

Gain access to institutional private credit offerings with 12% historic annual distributions

Invest like an institution for as little as $2,500. Access long-tenured, third-party sponsored multi-billion dollar alternative investments via Alture Funds. Open to all investors, regardless of accreditation.

Earn up to 12% passive income with Bluerock High Income Institutional Credit Fund, or invest in 35 real estate partnerships managed by Blackstone, CBRE, Invesco and others through Bluerock’s Total Income Plus Real Estate Fund.

Access institutional grade alternative investments through an app for the first time ever - buy shares in alternative assets with Alture Funds today.

🎤 PODCAST

"I think [solar energy] really does belong in almost every investor's portfolio." - Mike Silvestrini

In this episode of Smart Humans, Slava Rubin talks with Energea co-founder Mike Silvestrini about the renewable energy sector and the evolution of solar investments.

📰 NOTABLE NEWS

🪙 SEC & tokenized shares: Hester Peirce, the head of the SEC’s crypto task force, said that tokenized securities will still count as securities under the law, as companies like Robinhood and Republic look to use tokenization to open up private assets to retail investors.

🤖 Perplexity launches browser: The AI search engine startup debuted its new AI-powered web browser Comet to Perplexity Max subscribers, as it continues to try and compete with tech giants like Google and Microsoft.

🚀 Varda fundraise: The spacetech startup raised $187 million at an undisclosed valuation to continue expanding its efforts to manufacture pharmaceuticals in the microgravity of low Earth orbit - a concept that sounds straight out of science fiction.

⚾ Summer Sports card auction: Heritage’s most recent sports card auction generated $9.5 million in sales, with ten six-figure lots, led by a 1917 Babe Ruth card that sold for $244,000.

🏡 Rent forecast: Zillow is projecting that single-family rents will increase 2.7% in 2025, with multifamily rent expected to go up 1.3%.

🚀 Revolut’s new valuation: The UK-based banking startup is looking to raise $1 billion in funding at a $65 billion valuation, a year after being valued at $45 billion in a share sale.

Earn a 15% Annualized Return with Senior Living: Invest in the thriving $158 billion senior living market with Worthy Wealth.**

**sponsored link

📆 LOOKING FORWARD

This week: Financial earnings — J.P. Morgan Chase, Bank of America, Wells Fargo, Citigroup, BlackRock, Morgan Stanley, and Goldman Sachs will all report their quarterlies.

Tuesday: Consumer price index (CPI) and core CPI results released; Major League Baseball’s All-Star Game will be played at 8 PM ET in Atlanta.

Wednesday: Sotheby’s Natural History auction that includes a Ceratosaurus skeleton estimated at $5 million-plus, and the largest Martian meteorite estimated at $3 million-plus; Producer price index (PPI) and core PPI results released; Fed Beige Book on current economic conditions released.

Thursday: U.S. retail sales; Homebuilder confidence index; Sotheby’s Science & Technology auction featuring an Apple-1 computer expected to sell for $500,000.

Friday: Housing starts and building permits data released.

How would you rate this issue? |