- Alternative Investing Report

- Posts

- Alternative Investing Report - January 9, 2026

Alternative Investing Report - January 9, 2026

Happy Friday. Ben Miller gives us a public market pick, startup funding surged in 2025, CRE prices are slowly recovering, and crypto VC deal value nearly doubled. Let’s dive in!

📺 Watch: Our latest Pre-IPO investor briefing on the humanoid robotics sector, including in-depth looks at Figure AI, Apptronik, and Tesla.

This issue is brought to you by Grayscale, the largest digital asset-focused investment platform in the world.

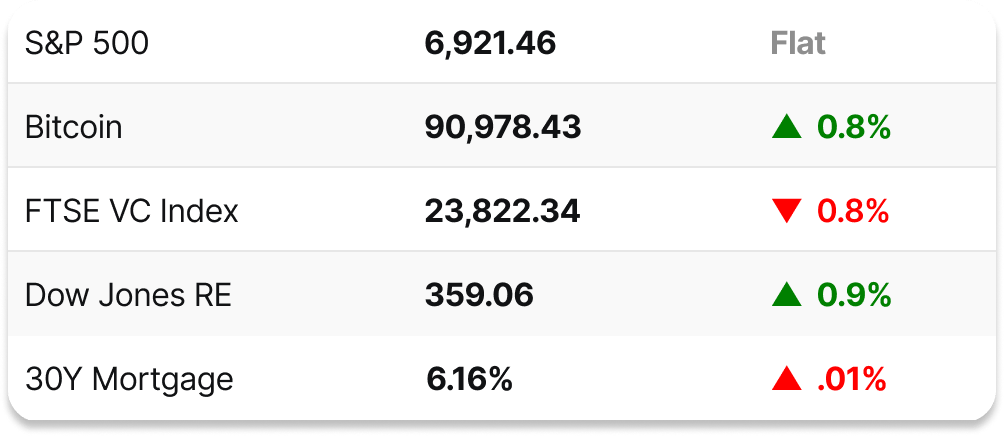

📈 DAILY MARKETS

✅ PICK OF THE WEEK

Mid-America Apartment Communities Inc. (NYSE: MAA)

Current share price: $138.54 (market cap: $16.22 billion)

I’ll go with a REIT that owns residential rental real estate, which should have a strong three years

MAA primarily owns properties in the Sun Belt

Another name to look at is Equity Residential (NYSE: EQR), which owns residential real estate in big, blue cities

They are sort of proxies for what Fundrise owns in its real estate portfolio

Here’s a list of our past expert investing picks.

How do you feel about today's pick? |

👨🏫 TODAY'S EXPERT

Ben Miller is Co-Founder and CEO of Fundrise, America's largest direct-to-investor alternatives investment manager. Fundrise’s mission is to use technology to build a better financial system for the individual investor — one that is simpler, lower cost, more reliable and transparent.

Partner

Invest in your share of the future

Grayscale offers a diverse suite of crypto investment solutions for individual investors, from single asset token exposure to strategically designed thematic exposure.

📺 EVENT REPLAY

Vincent's Slava Rubin and Sacra's Jan-Erik Asplund discussed the emerging field of humanoid robotics, exploring the convergence of AI and robotics and the various use cases for these robots. They look at the key players in the industry and the future outlook for the sector.

Presented by Augment, whose Collective funds are the easiest way to invest in the most popular private tech companies.

📰 NOTABLE NEWS

🚀 2025 startup funding: North American startup funding rose 46% in 2025, recording its highest total in four years, with roughly 60% of that funding going to AI-related startups. Q4 — the year’s second-highest quarter — was especially strong for early-stage fundraising, which was up 50% year-over-year.

🏢 CRE prices tick up: The Green Street Commercial Property Price Index (CPPI) showed a 2.3% annual gain in 2025, with all major sectors either positive or neutral, and with data center, strip retail and health care properties performing the best.

🪙 Crypto VC surges: Total crypto VC deal value nearly doubled in 2025, hitting $19.7 billion compared to $11.7 billion in 2024. The wave of crypto-related IPOs, including Circle, Gemini, and Bullish, brought liquidity to the space, and Kraken and Grayscale could continue the trend this year.

🏡 Milwaukee leads the way: While December saw the median list price decline for U.S. homes, Milwaukee posted the strongest price gains, as the Midwest and Northeast are still outpacing the South and West.

🤖 AI in Gmail: Google has introduced AI to Gmail, and it announced a new AI Inbox and integrated AI summaries, both of which could transform the way people interact with email.

🪙 World Liberty Financial seeks charter: The Trump-affiliated crypto firm announced that it is seeking a federal bank charter in order to issue its USD1 stablecoin. Given who is in charge of the office processing the application, it’s a safe bet that it will be approved.

📝 IN CASE YOU MISSED IT

Monday: 🤖 AI acquisitions, ⚾ Record card grading numbers

Tuesday: 🚀 2026 VC outlook, 🪙 Crypto upswing

Wednesday: 🏡 2026 RE outlook, 🎰 Polymarket housing bets

Thursday: 🚀 Potential 2026 IPOs, 📊 Jobs data

Have a great weekend!

How would you rate this issue? |