- Alternative Investing Report

- Posts

- Alternative Investing Report - January 27, 2025

Alternative Investing Report - January 27, 2025

Happy Monday. DeepSeek shook up the AI world, existing home sales hit a 30-year low in 2024, a copy of the Declaration of Independence was auctioned, and CRE investors are optimistic for 2025. Let’s dive in!

🎫 Attend: Today at 11 AM ET, our next pre-IPO briefing focusing on Anthropic, the $60 billion AI startup behind the LLM Claude.

This issue is brought to you by Bill.com, offering fraud protection and automated expense reporting for your business.

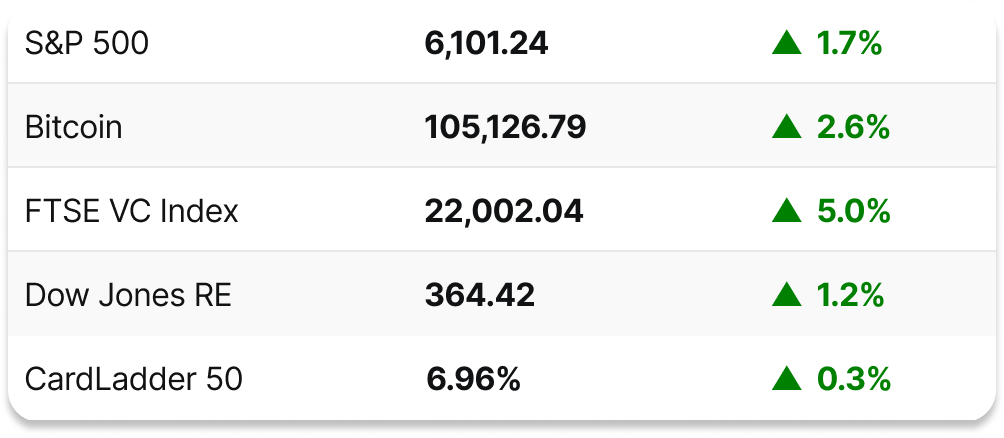

📈 WEEKLY MARKETS

🤖 DEEPSEEK

Last week, the Chinese AI startup DeepSeek released DeepSeek-R1, an open source large language model (LLM) that has the potential to turn the AI industry on its head. It matches or exceeds the performance of the most advanced models from OpenAI, Meta, and Anthropic and is significantly cheaper for users. What’s more, it supposedly only took two months to build and cost just $6 million.

➨ TAKEAWAY: DeepSeek’s results are a direct rebuke to the massive amount of capital AI startups are spending and raising by showing that models that cost billions to produce can be outperformed by a much cheaper competitor. This could be an existential threat to companies like OpenAI, xAI, and Anthropic if they can’t demonstrate significant improvements quickly. It is also a threat to NVIDIA’s dominance, as DeepSeek apparently created the model without any of their advanced AI chips, calling into question their necessity. The fallout from DeepSeek’s emergence is sure to be felt in the weeks and months to come, and investors should note that major sea changes should be expected in a nascent industry like AI.

Partner

Simplify with BILL. Get a BrüMate Backpack Cooler.

We love our customers—and the feeling is mutual! Demo BILL Spend & Expense and get $200 to spend with BrüMate.

“BILL gives me the capability to create as many virtual cards as I want. It makes budgeting easy. I use a different card for marketing, office expenses, etc and can set budget for each. All free, no hidden fees. Makes expense tracking extremely simple.” – Dylan Jacob, Founder @ BruMate

BILL gets you:

Customizable spending limits

Real-time tracking

Scalable credit lines

Take a demo and claim $200 to spend with BrüMate.1

1Terms and Conditions apply. See offer page for details. Card issued by Cross River Bank, Member FDIC, and is not a deposit product.

🎫 UPCOMING EVENT

Today at 11 AM ET - join a briefing covering the $60 billion AI startup Anthropic. Vincent’s Slava Rubin and Sacra’s Jan-Erik Asplund will discuss the company’s growth, strengths, challenges, IPO prospects, and much more.

🏡 EXISTING HOME SALES

Existing home sales totaled 4.06 million in 2024, the lowest annual number since 1995. However, December saw a 2.2% monthly gain and a 9.3% year-over-year increase, the highest increase since June 2021, as the market started to come back to life. The median sale price was $407,500 in 2024, a new record high, as sales for homes priced over $1 million actually rose by 35% year-over-year.

➨ TAKEAWAY: The housing market was quiet for most of 2024, as mortgage rates spent the year between 6% and 7%, and both buyers and sellers were waiting for rates to come down. Now that it looks like 7% is the new normal, people are starting to re-enter the market. The luxury market has been behaving differently, as evidenced by the significant gain in market activity for seven-figure homes, as luxury buyers and sellers are less affected by mortgage rates.

🏢 Access 10-14% Yields: Through Direct Real Estate Lending. Start investing with just $10K. Learn more →

**sponsored link

📰 NOTABLE NEWS

📜 Declaration of Independence sale: A rare 1776 printing of the Declaration of Independence sold for $2.4 million at Sotheby’s, towards the low end of the estimate, and significantly below a $3.36 million sale last July of a similar printing.

🏢 CRE investors optimistic: According to a CBRE survey, 70% of commercial real estate investors intend to purchase more assets in 2025, with nearly 75% of investors prioritizing multifamily buildings.

🎨 Sotheby’s sales drop: Total global sales for the auction house fell from $7.8 billion in 2023 to $6 billion in 2024, with auction sales dropping 28%, as the art market had a slow year overall.

💵 Private credit replacing IPOs: As startups stay private for longer, some are opting to meet their capital needs via private credit, such as software company Databricks and drug company Clario, who both inked multi-billion dollar private credit deals this month.

⚾ Paul Skenes 1/1 card: An 11 year-old boy pulled the rare debut patch card of the 2024 Rookie of the Year and is sending the card to auction rather than accepting the Pirates’ offer of 30 years of season tickets and other memorabilia.

🚀 Retro Biosciences raise: The Sam Altman-backed biotech company is raising a $1 billion Series A round to fund their efforts to extend human lifespan.

📆 LOOKING FORWARD

Today: The IRS starts accepting 2024 federal income tax returns; New home sales report released.

Tuesday: S&P Case-Shiller home price index, FHFA house price index released.

Wednesday: Federal Reserve announces its interest rate decision, and it is widely expected to make no change.

Thursday: GDP report released; Pending home sales report released.

Friday: Personal Consumption Expenditures (PCE) and Core PCE indices released.

Saturday: Heritage Auctions’ Winter Sports Card Catalog auction closes, notable items include a pair of Michael Jordan cards expected to sell for over $300,000 each.

How would you rate this issue? |