- Alternative Investing Report

- Posts

- Alternative Investing Report - January 13, 2026

Alternative Investing Report - January 13, 2026

Happy Tuesday. Gold and silver prices continue to surge, Jerome Powell is being investigated, mortgage rates hit a 3-year low, and a $1 billion memorabilia collection is coming to auction. Let’s dive in!

📺 Watch: Our latest Pre-IPO investor briefing on the humanoid robotics sector, including in-depth looks at Figure AI, Apptronik, and Tesla.

This issue is brought to you by Augment, whose Collective funds are the easiest way to invest in the most popular private tech companies.

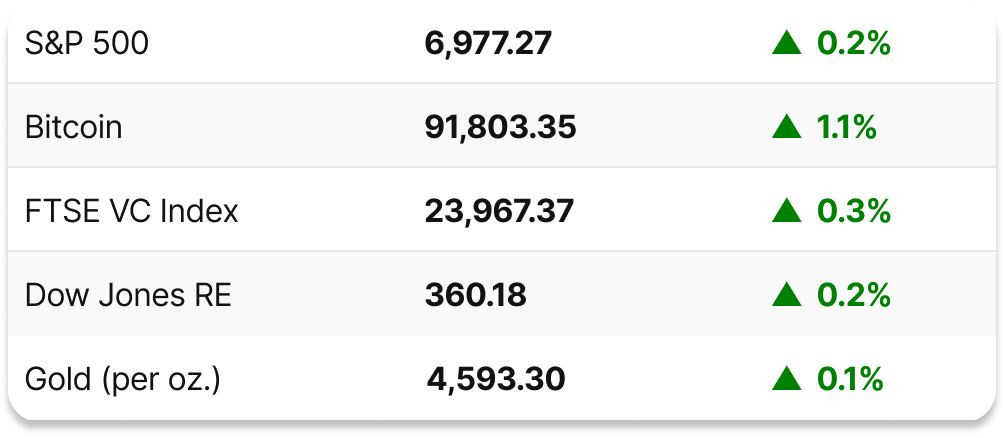

📈 DAILY MARKETS

💰 GOLD PRICES

Gold and silver prices both hit new highs and are up more than 6% in the last week, with the former topping $4,600 per ounce for the first time, and the latter exceeding $84 per ounce. This rally continues the trend that has seen gold rise more than 75% over the past year and silver prices nearly triple.

➨ TAKEAWAY: Gold clearly remains the core safe haven asset, despite some inklings that crypto, particularly Bitcoin, was ready to challenge it. That flip has not materialized, and as geopolitical and economic uncertainty continue to grow, with tensions in Iran, the U.S. military action in Venezuela, and Trump’s fight with Jerome Powell, investors continue to flock to precious metals.

📺 EVENT REPLAY

Vincent's Slava Rubin and Sacra's Jan-Erik Asplund discussed the emerging field of humanoid robotics, exploring the convergence of AI and robotics and the various use cases for these robots. They look at the key players in the industry and the future outlook for the sector.

Presented by Augment, whose Collective funds are the easiest way to invest in the most popular private tech companies.

📰 NOTABLE NEWS

🧑⚖️ Powell investigation: The Justice Department opened an investigation into Fed Chair Jerome Powell over testimony he gave to Congress last June. The move has been met with opposition by Democrats and Republicans alike and briefly sent stocks tumbling before they recovered. If the issue goes further or leads to any indications that Powell could be removed, it would likely have significant effects on markets.

🏡 Mortgage rates hit 3-year low: The average 30-year mortgage rate hit 5.99%, the first time it has dropped below 6% since early 2023, and mortgage refinancing applications are more than double what they were this time last year.

🎵 Jim Irsay collection: The late Colts owner’s legendary collection, which reportedly could be worth more than $1 billion and will start to be auctioned in March at Christie’s, includes guitars from Kurt Cobain, John Lennon, and Jerry Garcia, Ringo Starr’s drum set, and a whole host of sports and entertainment memorabilia.

🏢 CRE dry powder: Private real estate funds now have more than $250 billion in capital that can be used to buy up North American commercial properties, with investors targeting multifamily, industrial, retail, and more niche areas such as medical offices and self-storage facilities.

🤖 Countries block Grok: Indonesia and Malaysia have blocked access to xAI’s chatbot Grok over concerns that it is being used to generate sexually explicit images, in what could be the first of many such conflicts between AI innovations and local norms.

🚀 a16z fundraise: The powerhouse venture capital firm announced $15 billion of new funding over five funds, including a healthcare and infrastructure fund. Considering that the entire VC industry raised $66 billion in 2025, this announcement signals a good start to 2026.

Lightstone DIRECT’s first offering: Abernathy Industrial Park in South Carolina is currently open to investors. It is a fully leased, six-building logistics campus with a Proforma Net IRR of 15.2%.**

**sponsored link

🏡 LISTING OF THE WEEK

(Compass)

If you have $12 million lying around, a full-floor apartment in Midtown Manhattan could be yours at a $55.5 million discount to what it was last purchased at for in 2015. The 6 bed/9 bath 7,000 square foot co-op located on the 18th floor of the Sherry Netherland Hotel overlooks Central Park and comes with a number of luxury amenities. Why is it taking a more than 80% price cut from the last sale? It belonged to convicted fraudster Miles Guo, who was arrested in the apartment in 2023 and is now facing sentencing and whose assets, including the apartment, are being sold off in bankruptcy court.

How would you rate this issue? |